Volume 201

According to provisional PMI survey data from S&P Global, the U.S. economy gained speed in May. The service sector led the upturn, reporting the largest output rise for a year, but manufacturing also showed stronger growth.

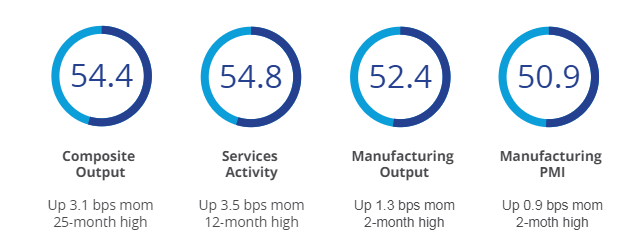

The headline S&P Global Flash U.S. PMI Composite Output Index rose sharply from 51.3 in April to 54.4 in May, its highest since April 2022. The 3.1 index point rise (the largest gain in 15 months) signals a marked acceleration of growth midway through the second quarter. Output has now risen continually for 16 consecutive months, with May’s acceleration contrasts with the slowdown seen in March and April.

Despite elevated inflation, businesses were optimistic about future growth in manufacturing and services. Customers were also reported to have become more upbeat.

S&P Global U.S. Composite Indexes

Source: S&P Global

Housing supply hits highest level since October 2021, but home sales dip

The total number of homes listed in April rose 16.3% from last year to 1.21 million units. Inventory of unsold homes was also up 9% from a month ago.

Despite the increase in inventory, sales of previously owned homes fell by 1.9% to an annual rate of 4.14 million in April. In addition, sales of new homes fell 4.7% to an annual rate of 634,000 in April, from a revised 665,000 in the prior month, as home buyers scaled back in the face of high mortgage rates.

The median price for an existing home in April rose 5.7% to $407,600 compared with the previous year. The median sales price of a new home sold in April fell to $433,500 from $439,500 in the prior month.

Source: MarketWatch

U.S. consumer sentiment darkens in May on worries of higher inflation

A monthly gauge of U.S. consumer sentiment conducted by the University of Michigan fell to its lowest level in six months in May on higher inflation expectations.

The second of two readings of the consumer-sentiment index was 69.1 in May, a sharp decline from 77.2 in April. The final reading was slightly higher than the initial estimate of 67.4.

“High prices, elevated interest rates, and concerns about the road ahead are weighing on consumers’ minds, but healthy incomes and solid household balance sheets are providing the offset to keep spending on a positive track,” said Oren Klachkin, a financial market economist at Nationwide.

Source: MarketWatch