Q3 2023

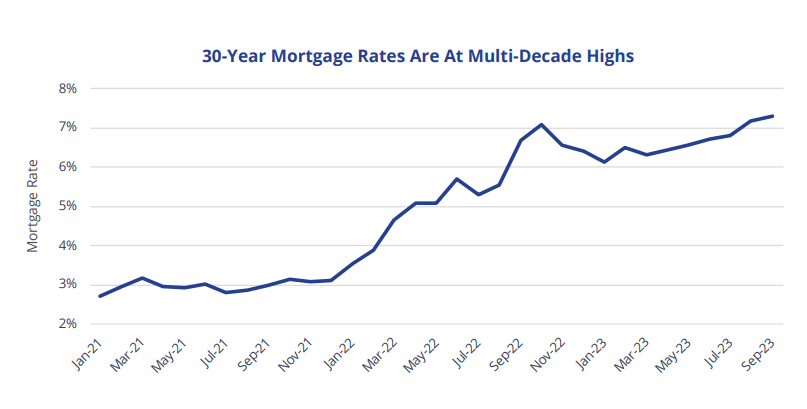

Investment sales volume continues to face pressure. Numbers are down more than 50% compared to last year’s Q3, and activity fell from Q2. Heading into Q4, uncertainty is the theme. During the third quarter, the U.S. Government’s unsettled funding caused interest rates to rise. The Fed’s consistent phrasing of a ‘higher for longer’ environment, combined with forecasts suggesting potential future rate hikes and a slower rate decline in 2024, has only added pressure. Union strikes, a pullback in lending, volatile oil prices, and sticky inflation all added to the confusion of market conditions. The war between Israel and Hamas has investors on edge in Q4.