VOLUME 206: WEEK ENDING JUNE 29, 2024

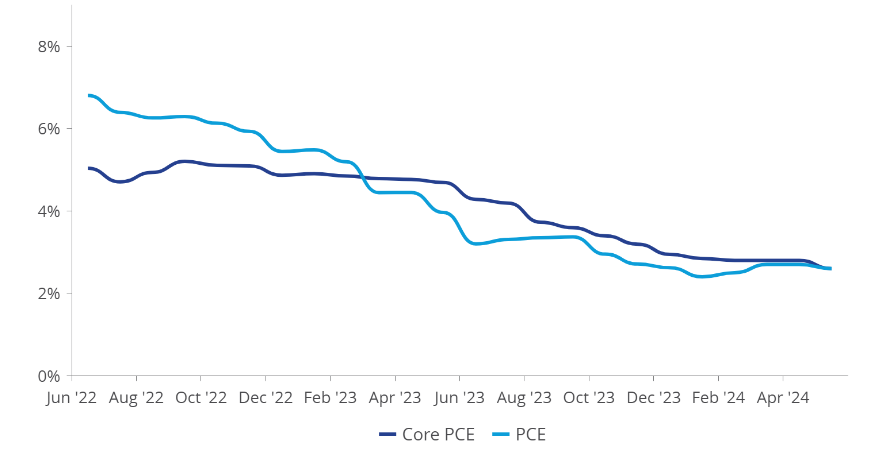

The Federal Reserve’s preferred measure of inflation eased slightly in May, reaching its lowest level in over three years, potentially strengthening the case for an autumn rate cut.

The Bureau of Economic Analysis’ PCE Price Index report showed that core prices (excluding food and energy rose at an annual rate of 2.6% last month. This matched Wall Street’s forecast and was modestly lower than the readings from the previous two months, marking the slowest increase since March 2021.

According to the CME Group’s FedWatch tool, the market anticipates no interest rate change from the Federal Reserve when its two-day policy meeting concludes on July 31. However, the probability of a rate cut in September is rising, with market bets reaching around 66%. There is also ongoing debate about the likelihood of a second rate cut before the end of the year.

Source: Yahoo Finance

Weak durable-goods orders show manufacturers still stuck in mud

Orders for durable goods, including autos and computers, barely rose in May, highlighting ongoing industrial weakness in the U.S. economy.

Manufacturers have struggled over the past year due to high interest rates and consumer spending shifting towards services like travel.

New orders increased by just 0.1% in May despite economists predicting a 1.0% drop. While the May report was better than expected, April’s increase was revised from 0.6% to 0.2%.

Much of the weakness was due to Boeing’s poor performance, with commercial aircraft bookings sliding 2.8% amid safety issues. However, orders for new cars and trucks unexpectedly rose by 0.7%, helping new orders surpass Wall Street expectations.

Source: MarketWatch

New-home sales plunge to lowest level since November

Sales of newly built homes in the U.S. plunged in May, reaching their lowest levels since November, as home buyers pulled back due to high mortgage rates.

New-home sales fell 11.3% in May to an annual rate of 619,000, down from a revised rate of 698,000 in April.

This decline was driven by a significant 44% drop in the Northeast, followed by decreases in the South, Midwest, and West. Overall, new home sales are down 16.5% compared to the previous year.

Source: MarketWatch