Volume 202: Week Ending June 1, 2024

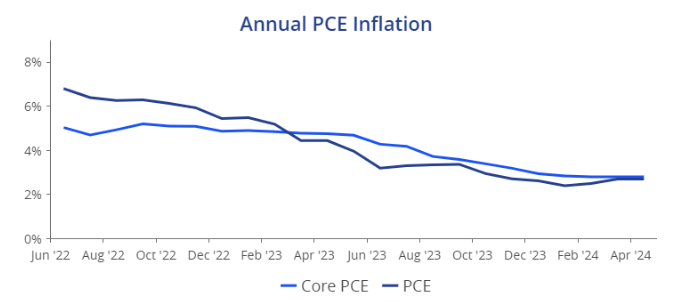

The PCE index increased by 0.3% last month, while the core rate, which excludes food and energy and is the Federal Reserve’s preferred measure, rose by a modest 0.2%. This marks the smallest gain since December 2023.

The slight increase in the core PCE deflator aligns with consensus expectations and suggests an improvement in inflation compared to the first quarter. Both headline and core inflation remained unchanged year-over-year, indicating that multiple favorable reports will be necessary before the Fed feels confident enough to begin cutting interest rates.

With four more inflation reports expected before the September FOMC meeting, the possibility remains that the Fed will cut rates at that meeting, however, the markets are now favoring an initial rate cute in December.

Source: Oxford Economics

U.S. April trade gap in goods widens to largest deficit in almost two years

The U.S. trade deficit in goods widened 7.7% to $99.4 billion in April, the widest deficit since May 2022, as demand from U.S. consumers outpaces other countries.

Economists polled by Econoday were looking for the deficit to widen to a $92.5 billion deficit.

Wholesale inventories rose 0.2% in April. Additionally, advanced retail inventories rose by 0.7% after a 0.1% increase in March. When excluding autos, retail inventories saw a 0.3% rise.

Source: MarketWatch

Consumer spending shows signs of weakness

Consumer spending in April showed signs of stress. Spending rose by 0.2% before adjusting for inflation, but fell slightly when inflation was considered.

Most of the spending increase went towards necessities like rent, utilities, medical care, gas, and insurance, leaving less for discretionary items such as travel, recreation, and consumer electronics.

There was a notable decline in recreational spending, and fewer cars were purchased, prompting auto dealers to reduce prices or offer better incentives due to high interest rates and monthly payments deterring buyers.

Source: MarketWatch